Understanding the Bond Market: A Trillion-Dollar Giant

The bond market, a financial landscape worth over $1 trillion, profoundly impacts aspects of your life, from mortgage rates and job security to investment returns and even cryptocurrency prices. Despite its significance, many individuals lack a fundamental understanding of its operations and purpose. This market is distinct from the stock market and Bitcoin; it's the bond market, a cornerstone of the global financial system.

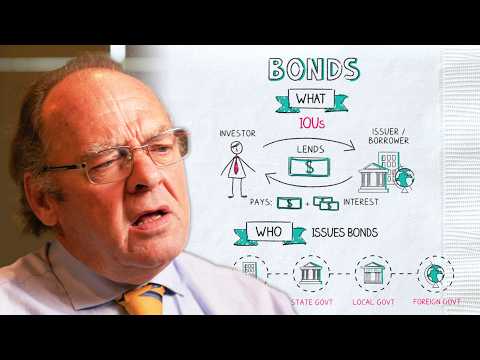

What is a Bond?

Imagine starting a business. You possess a compelling idea and a solid plan, but lack the necessary capital. You would likely borrow money, promising to repay the lender with added compensation, which is called interest. Bonds operate on this same principle.

Companies and governments often need to borrow money. When they do, they issue bonds, becoming the borrower or issuer. The individual or institution providing the funds is the lender or investor.

Government Finances and Bonds

Governments consistently spend money on various public services like infrastructure, military defense, and healthcare. This spending stimulates the economy by creating jobs and fostering productivity amongst citizens and businesses. Productive citizens and businesses generate tax revenue, which forms the bulk of a government's income.

Despite tax revenues, governments often spend more than they collect, leading to a budget deficit. This annual deficit contributes to the national debt, the total amount a government owes from past borrowing. As of 2025, the UK's national debt is £2.7 trillion, while the US's stands at a staggering $36.7 trillion.

To cover these deficits, governments issue bonds. The Treasury holds auctions where bonds are sold to investors globally, including banks, insurance companies, pension funds, foreign governments, and individuals. These bonds are attractive to investors because US government bonds are generally considered very safe investments.

Key Bond Terms

Understanding bond terminology is crucial:

-

Principal: The amount being invested or borrowed.

-

Coupon: The annual interest payment, expressed as a percentage of the principal.

-

Maturity: The date when the loan is due, and the investor receives their principal back.

-

Yield: The total return an investor receives from the bond, which can differ from the coupon due to price fluctuations.

The price of a bond and its yield have an inverse relationship. If the price of a bond decreases, its yield increases, and vice versa. However, the coupon rate always remains the same.

Bond Prices and Market Dynamics

Bond prices are determined in two markets:

- Primary Market: The government sells new bonds through Treasury auctions on a set schedule (weekly or monthly). The yield at auction is determined by the demand for those bonds. This yield then sets a benchmark.

- Secondary Market: Investors buy and sell existing bonds. The investors reassess the value of bonds that are already in circulation, constantly speculating on future interest rate movements, economic growth, and inflation. Their expectations shape the yields they demand.

Ultimately, market interest rates reflect the yields demanded by global bond investors based on their expectations for the future.

Impact of Market Rates

Rising market rates increase the government's borrowing costs. The US government's interest payments alone currently amount to approximately $3 billion daily. A significant portion of government debt is in short-term Treasury bills that constantly reset, requiring the government to continually "roll over" the debt.

This continuous borrowing leads to an increasing debt burden, diverting government funds away from essential services like healthcare, infrastructure, and social programs. To maintain these services, governments often resort to further borrowing, exacerbating the problem.

Bonds and the Stock Market

Bonds offer a relatively safe investment, as the government guarantees repayment with interest. Stocks, conversely, carry more risk, as their value is tied to a company's performance.

Investors often choose bonds over stocks when bond yields rise because the risk-adjusted return becomes more favorable. This dynamic influences the equity risk premium (ERP), the difference between expected stock market returns and government bond interest rates. As bond yields increase, the ERP shrinks, making stocks less attractive and potentially triggering sell-offs.

Government Bonds vs. Corporate Bonds

-

Government bonds are issued by governments and are considered safer due to the low risk of government default.

-

Corporate bonds are issued by companies and carry a higher risk of default due to the possibility of bankruptcy.

The difference in yield between safer government bonds and riskier corporate bonds is called the high yield spread. A widening spread often signals market uncertainty.

The bond market influences the economy because rising interest rates generally slow down economic activity.