Managing Risk in Trading: A Guide to Avoiding Disaster

If you aim to remain active in the market a year from now, mastering risk management is crucial. Large returns in a short time don't make you a trading expert, and without proper risk controls, you risk losing everything. This guide provides advice to help prevent account blow-ups and guide you towards more sustainable trading practices.

The Importance of a Trading Plan

Before entering any trade, develop a well-defined plan. Trading impulsively, such as hitting "send order" when your heart rate is elevated, is a recipe for disaster. A well-thought-out plan ensures you're comfortable with all potential outcomes and know your entry and exit points in advance. If you feel like you're trading like an idiot, you probably are.

Limiting Portfolio Risk

-

Never risk more than 5% of your portfolio on a single trade. This isn't a recommendation to automatically risk 5%; your risk tolerance should be considerably less than that.

-

Assess your psychological comfort level. Can you handle a 5% loss without emotional distress? If losing that amount would be devastating, reduce your risk further. The point is that you should be able to sleep soundly after entering your trades.

Stop Losses and Take Profits: Essential Tools

A crucial part of your trading plan is determining stop-loss and take-profit levels before entering a trade. These levels make trading more mechanical and less emotionally driven.

Placing Stop Losses Strategically

-

Technical Analysis is key: Use technical indicators to set stop losses and take profits, based on the chart pattern.

-

Consider Support and Resistance Levels: Areas of support, resistance, and moving averages can guide your stop-loss and take-profit placement.

-

Account for Portfolio Risk: Ensure your stop loss is set so that your losses do not exceed 5% of your account balance.

Example: Microsoft Swing Trade

Consider Microsoft stock trading within a channel in October 2018. If you're considering a long position at the support level, you need to set your stop loss strategically.

-

Below the Support Level: Position your stop loss below the support level to avoid being prematurely stopped out by minor price fluctuations that retest the support.

-

Volatility: Consider Microsoft's high volatility to give the stock "room to breathe" and avoid getting stopped out unnecessarily.

Take Profit Strategies

Set your take profit at the resistance level. Alternatively, in less volatile scenarios, use a trailing stop loss. As the stock price increases, adjust your stop loss upwards to lock in profits. This approach is not recommended for Robinhood users, or other brokerages that do not have the Trailing Stop Loss feature. As it must be done manually.

Options Trading and Risk

-

Predicting Option Value is Difficult: Don't use Stop Losses on options, because the values of options are based on more than just the value of the stock.

-

Profit/Loss-Based Exits: For options, focus on predetermined profit and loss targets for exiting trades. Monitor the underlying stock's movement, but prioritize the option's profit/loss.

-

Risk "House Money": Consider investing your initial capital in safer investments and using profits from successful trades ("house money") to trade options.

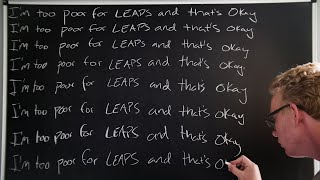

Avoiding Out-of-the-Money Options

Avoid out-of-the-money options unless you're day trading or employing strategies like credit spreads or naked options. Think of them as lottery tickets. While potentially lucrative, they pose a high risk compared to their potential reward, particularly when starting out.

Diversification: Another Method to Limit Risk

Diversification reduces overall risk. Diversify across:

-

Long-term investments

-

The number of stock positions

-

Option strategies and underlying assets

-

Liquidity is key! Trade options that are highly liquid.

Humility in the Market

The market has a way of humbling even the most confident traders. Manage your risk, stay disciplined, and avoid arrogance. This will help you remain profitable and survive market downturns.

{#

{#  {#

{#  {#

{#  {#

{#  {#

{#