Living on Margin: A Dividend Investing Strategy

This article explores a dividend investing strategy where income is generated from a brokerage account, specifically Robinhood, to cover living expenses. The strategy involves leveraging margin to amplify returns. The goal is to create a self-sustaining system where dividends pay down the margin used for expenses.

Background and Platform Shift

The presenter, Alex from 95 to Freedom, discusses his shift from Fidelity to Robinhood. He initially used Fidelity for his 401k, IRA, and credit card. However, a 30-day margin restriction after a wash sale, combined with attractive transfer incentives and lower margin rates from Robinhood, prompted the switch.

Why Robinhood?

-

Attractive transfer incentives

-

Lower margin rates

Portfolio Overview

Alex showcases his Robinhood portfolio, revealing an investment of roughly $252,000 of his own money. The portfolio is diversified across various positions, reflecting a risk-versus-reward strategy refined over nine months. He emphasizes that this is not financial advice and encourages viewers to conduct their own research.

Top Holdings: The "Dividend Avengers"

Alex highlights his top four holdings, all from Roundhill Investments, which he playfully refers to as the "Dividend Avengers":

-

XDTE: Diversified on the S&P 500, pays roughly 24-25 cents per share weekly.

-

QDT: Pays around 23 cents per share weekly.

-

MAGI (Magnificent 7): Pays approximately 35% per year.

-

YBTC: A Bitcoin play.

He mentions other positions and directs viewers to his other content for details on entry and exit strategies for those.

Dividend Tracking and Income

Alex utilizes a spreadsheet to track weekly dividend income from each position. Last week's income approached $3,000. He provides specific examples of weekly payouts, such as $533 from XDT and $598 from QDT. He notes he's earned over $50,000, and is tracking the portfolio's NAV.

NAV Considerations

Alex addresses the concern of NAV (Net Asset Value) erosion, a common issue with some high-yield funds. He explains his preference for Roundhill and NEOS funds because they tend to maintain their NAV better. While NEOS funds may offer lower payouts, they provide a stable anchor to the portfolio.

Projected Income and Margin Usage

Alex projects an annual dividend income of $175,000 based on current holdings and dividend rates. Factoring in the $8,600 annual margin cost, the projected net income is around $167,000, representing a 65% ROI.

Margin Details

-

Margin available: $430,000

-

Margin currently used: $200,000

-

Annual margin rate: 5.25% (first $1,000 interest-free)

He emphasizes that margin comes with inherent risks, similar to any borrowed funds. However, he believes it can be a valuable tool when used responsibly, particularly in a stable or bull market.

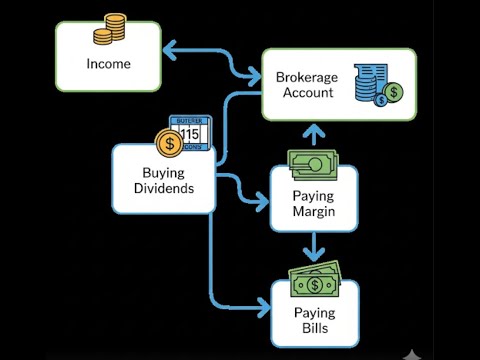

The System Explained

The strategy revolves around channeling all income into the brokerage account to purchase dividend-paying assets. Margin is then utilized to cover living expenses (debt, bills, and other costs). This approach allows for the compounding of dividends and maximizes investment potential.

Paying Bills with Margin

Rather than using income directly for expenses, Alex withdraws from his available margin to cover them. He argues that the lower margin rate (5.25%) makes it more advantageous to invest in higher-yielding dividend assets.

Dividend Repayment

Dividends received are automatically applied against the outstanding margin balance. This effectively minimizes the interest accrued on the margin used for expenses, as the dividends quickly offset the borrowed funds.

Risks and Hedging

Alex acknowledges the risks associated with this strategy, primarily market volatility and potential dividend reductions. He emphasizes the importance of responsible leverage and maintaining reasonable risk levels.

Hedging Strategy

To mitigate risks, Alex diversifies his investments beyond the dividend portfolio, including real estate and rental properties. This provides a financial safety net and helps cover living expenses in case of market downturns or dividend cuts.

Conclusion

Alex hopes he has clearly explained this dividend investing strategy. He encourages viewers to ask questions in the comments and to like and subscribe for more content. He also provides a referral link for Robinhood, which benefits both the user and the channel.