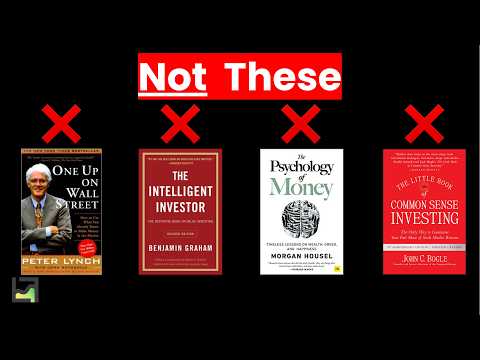

Top 10 Investing Books According to Goodreads

This article reveals the top 10 investing books based on Goodreads.com ratings, offering key insights from each book. Goodreads was chosen over Amazon for its larger review base and harsher critics, suggesting that highly-rated books on Goodreads are more likely to be exceptional.

Criteria for Selection

The selection criteria for this list included:

-

Minimum Ratings: The book had to have at least 1,000 ratings.

-

Focus on Investing: The book had to primarily be about investing, not just personal finance or business principles.

-

Original Work: The book had to be original work by the author, not a compilation of others' writings.

The Top 10 Investing Books

Here are the 10 best investing books of all time according to Goodreads, along with three core investing insights from each:

10. Security Analysis by Benjamin Graham and David Dodd

Rating: 4.3 stars with over 9,000 reviews.

Key Takeaways:

-

Know the Business: Thoroughly understand a company's financials before investing.

-

Intrinsic Value: Invest only when a company's market price is below its intrinsic value.

-

Protect the Downside: Prioritize the safety of principal over chasing high returns.

9. The Most Important Thing by Howard Marks

Rating: 4.32 stars with over 15,000 reviews.

Key Takeaways:

-

Risk Awareness: Focus on managing the downside instead of maximizing the upside.

-

Second-Level Thinking: Think deeply about second-order consequences, going beyond the obvious.

-

Cycle Awareness: Understand how market cycles work to avoid costly mistakes.

8. Margin of Safety by Seth Klarman

Rating: 4.33 stars with over 6,000 reviews.

Key Takeaways:

-

Buy with a Cushion: Always invest with a margin of safety to protect against uncertainty.

-

Irrational Markets: Take advantage of the emotions and short-term thinking of others.

-

Be a Contrarian: Great opportunities often look uncomfortable at first glance.

7. The Five Rules for Successful Stock Investing by Pat Dorsey

Rating: 4.38 stars with over 1,800 reviews.

Key Takeaways:

-

Understand the Business: Know what will drive the company and make it successful.

-

Dig into the Financials: Analyze the income statement, balance sheet, and cash flow statement to assess business health.

-

Focus on Moats: Invest in companies with a sustainable competitive advantage.

6. How to Avoid Loss and Earn Consistently in the Stock Market by Prasenjit Paul

Rating: 4.39 stars with over 2,300 reviews.

Key Takeaways:

-

Capital Preservation First: Avoiding big losses is the key to compounding.

-

Clarity over Complexity: Use simple frameworks to avoid emotional mistakes.

-

Asymmetric Opportunities: Seek low-risk, high-reward stocks with minimal downside risk.

5. Poor Charlie's Almanack edited by Peter Kaufman

Rating: 4.41 stars with over 15,000 reviews.

Key Takeaways:

-

Circle of Competence: Only invest in businesses you deeply understand.

-

Avoid Big Mistakes: It's easier to avoid stupidity than to chase brilliance.

-

Long-Term Thinking: Buy great businesses and let compounding do the heavy lifting.

4. The Simple Path to Wealth by JL Collins

Rating: 4.43 stars with over 27,000 reviews.

Key Takeaways:

-

Keep it Simple: Investing in simple index funds consistently beats complexity.

-

Avoid Debt: Freedom grows when you minimize financial obligations.

-

Buy Yourself Time: Money's highest use is to acquire control over your time.

3. The Joys of Compounding by Gautam Baid

Rating: 4.45 stars with over 1,600 reviews.

Key Takeaways:

-

Play the Long Game: Time and discipline are the most powerful forces in investing.

-

Continuous Learning: Reading, reflection, and humility compound like capital.

-

Values and Ethics Matter: Ethics and integrity are part of a sustainable edge in investing.

2. Richer, Wiser, Happier by William Green

Rating: 4.53 stars with over 6,800 reviews.

Key Takeaways:

-

Invest Like the Best: Study the investing greats and personalize their principles.

-

Focus on the Inner Game: Patience, humility, and emotional control drive long-term success.

-

Simplification is Key: Focus on simple ideas that you deeply understand.

1. What I Learned About Investing From Darwin by Pulak Prasad

Rating: 4.58 stars with over 1,500 reviews.

Key Takeaways:

-

Adaptability is Key: Adaptability is more important than strength for long-term survival.

-

Avoid Extinction Events: Protect yourself from ruin by avoiding excessive risk.

-

Small Consistent Edge: A small edge, compounded over time, can lead to long-term dominance.