Japan's Pursuit of Rare Earth Resources in the West Pacific

Japan is actively seeking alternative rare earth resources to reduce its dependence on China, particularly in light of geopolitical considerations in the West Pacific Sea. This effort involves exploring both alternative suppliers and deep-sea mining opportunities. Countermeasures are being developed to address this reliance.

Diversifying Rare Earth Supply Chains

After the 2010 fishing island incident, Japan started diversifying its rare earth suppliers. One prominent partnership is with Lynas, an Australian company possessing large-scale rare earth separation facilities outside of China. Lynas processes Australian ore in Malaysia with Japanese funding and technical assistance, securing long-term supply agreements. Through such supply chain adjustments, Japan has reduced its dependence on China for tin from 90% to approximately 50%. However, dependence remains significant in some areas.

Exploring Deep-Sea Rare Earth Resources

Japan has also begun exploring seabed resources. While the soil density of these resources is not exceptionally high, the distribution of rare earth elements on land is unequal, prompting the exploration of deep-sea alternatives. Many countries, including Malaysia, India, Vietnam, and Myanmar, possess rare earth mines but lack sufficient processing capabilities.

The Significance of Heavy Rare Earth

Rare earth elements are classified into green and heavy categories, with heavy rare earth possessing significantly higher industrial value. Many land-based mines, including those in the US and Australia, have a lower heavy rare earth content compared to mines in southern China. This disparity has driven the exploration of seabed resources.

Deep-Sea Exploration and Potential

Global exploration of deep-sea rare earth resources has intensified in recent years, with the seabed offering vast potential due to its large radiation area and international access. In 2011, Professor Kato Takao from the University of Tokyo led a team that analyzed the Pacific Ocean floor, revealing that a 2-meter-thick layer contains rare earth elements equivalent to southern China's Li-Zi-Xifu mines. Notably, the heavy rare earth content was twice as high, which is particularly valuable for defense applications. Common land is found mainly in the Li-Zi-Xi-Fu mine in southern China.

Japan's research team discovered a promising site near Nanyo Island, located 1848 kilometers from Tokyo and part of Tokyo Prefecture. Research in 2018 estimated that an area of 2,500 square kilometers south of Nanyo Island contains approximately 16 million tons of rare earth oxides. This reserve could supply the global demand for Di and Te for 730 and 420 years, respectively.

Advantages of Seabed Rare Earth Mining

Seabed mining offers several key advantages:

-

Large Soil Quantity: The total storage volume may exceed existing land-based resources. The Nanyang Island mine area represents only a small percentage of land-based estimates. Seabed rare earth represents an extension of existing land resource.

-

Green Industrial Resource: Seabed mines lack volatile elements like oil and soil, unlike land-based rock mines that produce volatile elements, simplifying processing and reducing environmental impact. The seabed soil lacks carbon dioxide elements.

-

Easy Accumulation: Sediment accumulates in the public system, with concentrations twice as high as on land and public system concentrations of 30% to 50%, comparable to the Li Zi Xifu mine in Jiangxi.

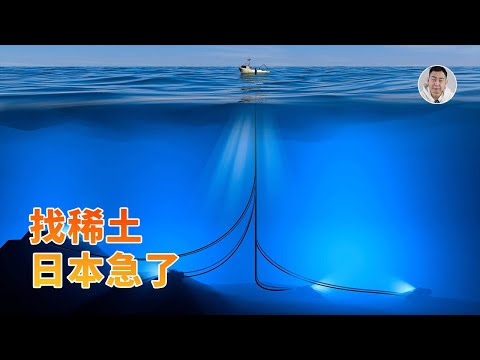

Challenges of Deep-Sea Mining

Despite the potential, deep-sea mining at depths of 5,000 to 6,000 meters presents significant challenges.

-

The process involves extracting mud, separating elements, and returning processed mud.

-

Remote, deep-sea locations pose weather-related risks and limit operational windows.

-

The extreme pressure at these depths (600 to 800 kilograms per square centimeter) requires specialized equipment and design considerations.

Japan tested a bump system at a depth of 2,470 meters in 2017, and the government has funded the development of 6,000-meter-high cement pipe technology.

Future Prospects and Potential Obstacles

Japan aims to conduct a 5,500-meter-deep test in January 2026, which, if successful, would open a new field of western soil mining development. However, challenges remain beyond technological hurdles, including potential environmental impacts on marine ecology and political considerations. Large-scale development in the sea will almost certainly affect the overall marine ecology.

Potential Impact on China's Dominance

While deep-sea mining holds long-term potential, it faces numerous obstacles, including building production capacity, securing capital, navigating auditing processes, and addressing market issues. This suggests that Japan may find it difficult to avoid China's leading position in this sector, at least in the short term.

China possesses considerable soil reserves, a well-established industrial chain, and a robust market network. Although Japan has basic capabilities in soil extraction and downstream products, its local production capacity lags behind China, particularly regarding soil elements and the products themselves. Japan currently relies heavily on China in these areas.

{#

{#  {#

{#  {#

{#  {#

{#  {#

{#